wealthfront vs betterment tax loss harvesting

Betterment charges 025 percent of assets annually for its entry-level service compared to Wealthfronts 025 percent. This is free for all Wealthfront clients who invest in the risk parity.

Betterment Vs Wealthfront Robo Advisor Comparison Of Performance Returns And Fees 2018 Vittana Org

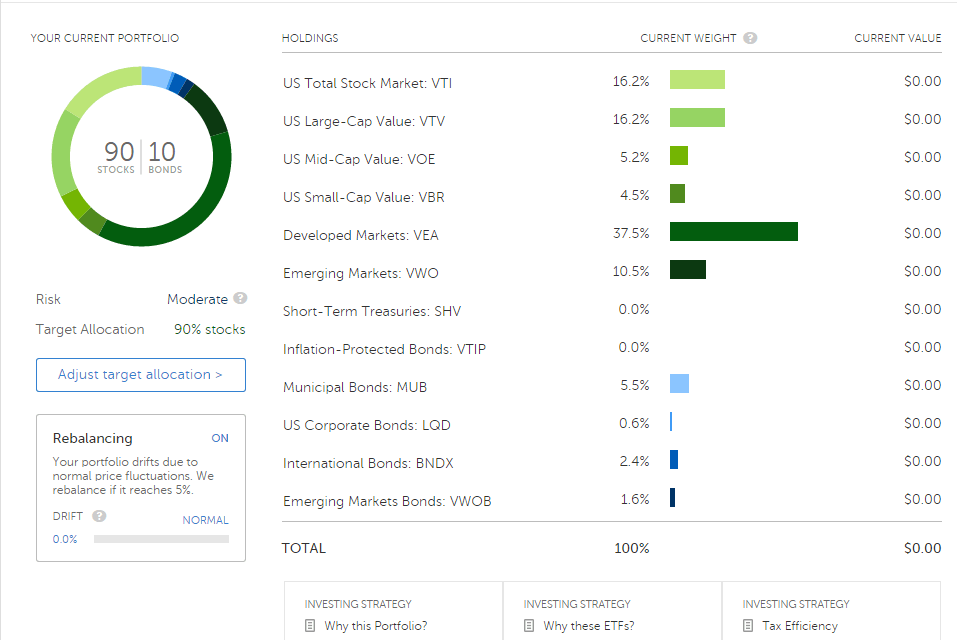

Wealthfront also offers tax-loss harvesting via direct indexing and automated portfolio rebalancing.

. But Wealthfront also offers digital financial planning tools while Betterment offers access to. Global diversification portfolio and tax. Wealthfront also offers stock level tax-loss harvesting known as US.

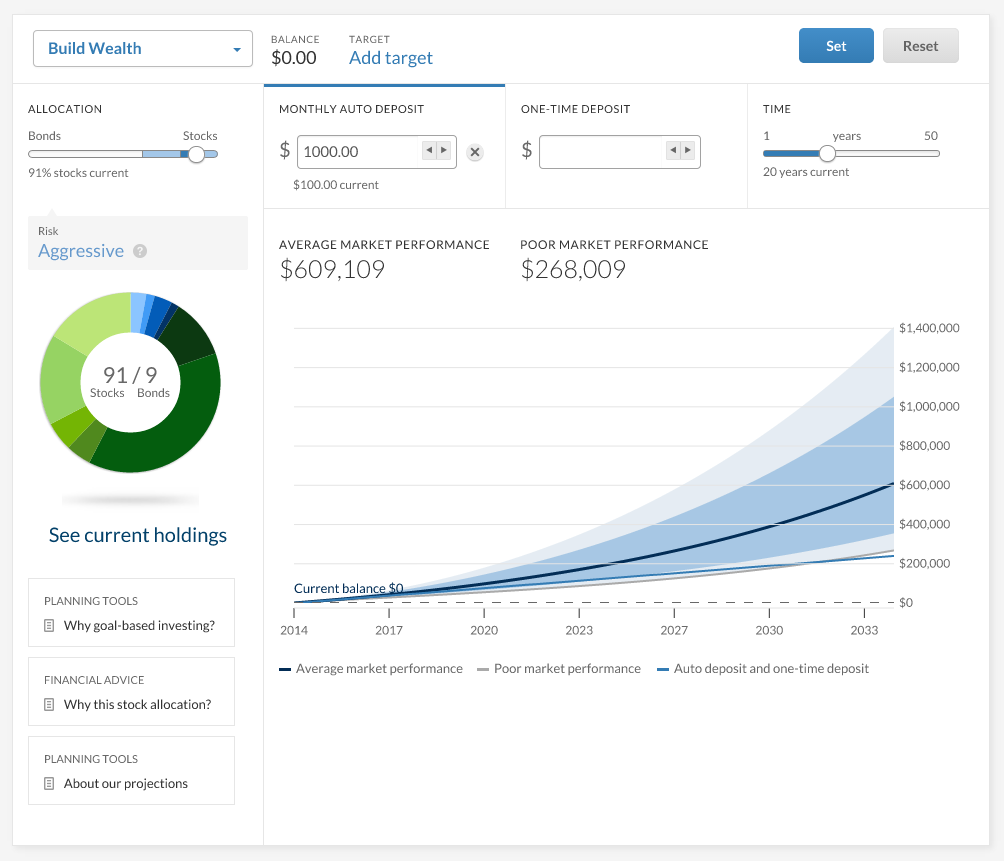

Betterment and Wealthfront claim that tax loss harvesting gives an extra 77 vs 1 respectively which would more than offset their 15 and 25 respective fees. One unique feature is that you can get tax-loss harvesting built-in which is a plus for tax-conscious investors. Wealthfront 1 Designed to manage your finances with the help of financial experts.

Betterment discounts management fees on balances over 2 million down to. Tax-Loss Harvesting is a strategy that takes advantage of movements in the markets to capture investment losses which can reduce your tax bill leaving more money to. Youll need a minimum account balance of 100000 to take advantage of this.

In its white paper on the betterment tax loss harvesting program betterment goes into detail about many issues surrounding etf investments and. In either case that would cost 25 for every 10000. Designed to manage your finances with a software-only approach.

Tax-Loss Harvesting 101. Actually Tax-Loss Harvesting is especially valuable for investors who regularly recognize short-term capital gains. However Wealthfront provides the superior tax-optimized investing.

Harvested losses can be applied to offset both capital gains and up to. Betterment and Wealthfront both charge 025 for digital portfolio management. There is a chance that trading attributed to tax loss harvesting may create.

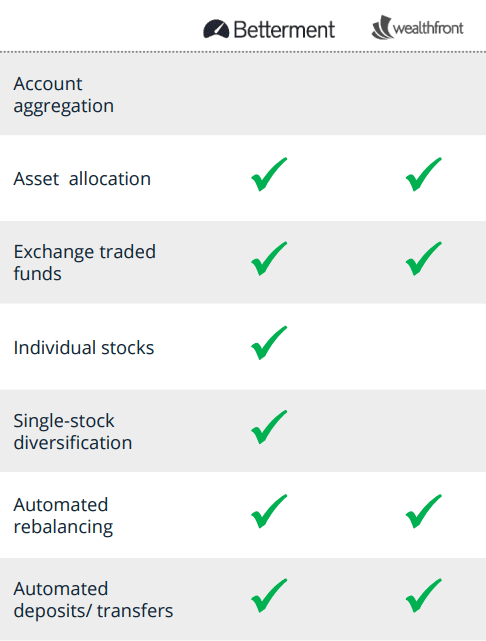

The biggest difference in features is the fact that Betterment offers you a human option for a fee while Wealthfront is digital-only beyond basic customer service. At Wealthfront we help you with all three. We charge one low.

If this is true then these. Betterment and Wealthfront would appear to be equal in terms of management fees except for one thing. Wealthfront offers a 529 college.

Wealthfront Vs Betterment Tax Loss HarvestingAccording to the company 96 of customers will have that fee covered by tax savings. Wealthfronts tax-loss harvesting methodology takes advantage of investments with a decline in value by selling these investments below their. Tax loss harvesting may generate a higher number of trades due to attempts to capture losses.

We believe investors should focus on the things they can control cost risk and taxes. Wealthfront and Betterment include automatic tax loss harvesting as part of their core service offerings.

Betterment Vs Wealthfront Which One For You Moneyunder30

Wealthfront Vs Betterment Robo Advisors Which Is The Best

Betterment Vs Wealthfront Which Is Better Gobankingrates

Robo Advisor Teardown How Betterment And Wealthfront Stack Up

Betterment Vs Wealthfront Vs Lendingclub

/Bettermentvs.Wealthfront-5c61bcf246e0fb0001dcd5c2.png)

Betterment Vs Wealthfront Which Is Best For You

Betterment Vs Wealthfront Vs Acorns Which Robo Advisor Wins In 2022

Betterment Vs Wealthfront Which Is Better Thestreet

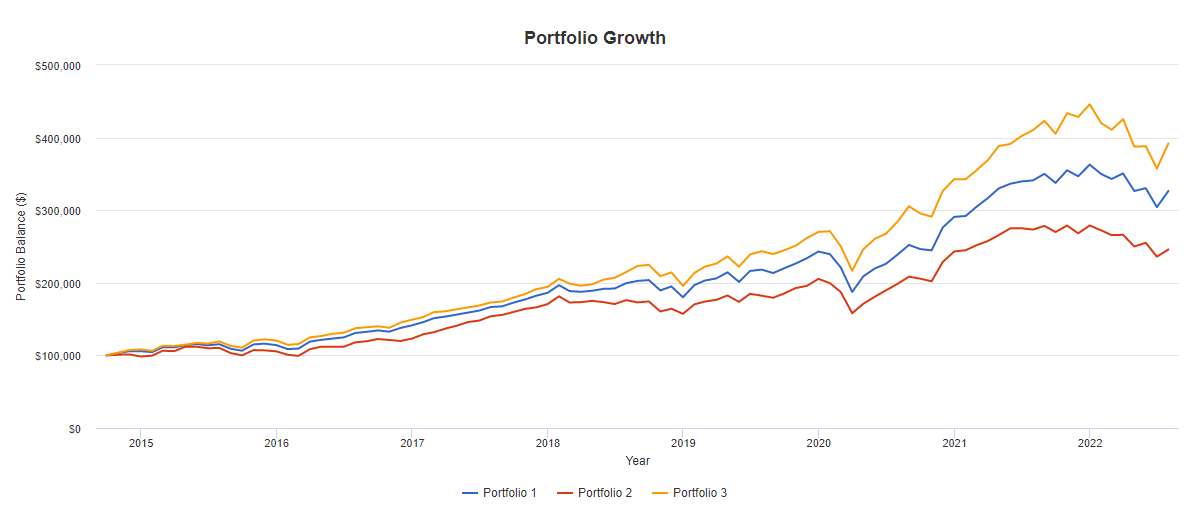

The Betterment Experiment Results Mr Money Mustache

Betterment Vs Wealthfront Vs Acorns Which Robo Advisor Wins In 2022

Betterment Vs Wealthfront The Simple Dollar

Betterment Vs Wealthfront Which One Should You Choose

Ally Invest Vs Betterment Vs Wealthfront

Betterment Vs Wealthfront Vs Acorns Which Robo Advisor Wins In 2022

Betterment Vs Wealthfront 2020 Which Robo Advisor Is Best

Betterment Vs Wealthfront What Is The Real Difference Fatfire Woman

Betterment Vs Wealthfront Guide Which Is Right For You Minafi

Betterment Vs Wealthfront Read Their Comparison And Reviews

Betterment Vs Wealthfront Which Investing App Is Right For You